Key Points Covered

- What Zipphy claims about regulation

- Domain mismatch and licensing issues

- User experiences and complaints

- Overall risk analysis of Zipphy

Zipphy Overview

- Official Website- https://zipphy.com/

- Website Availability- Yes

- Headquarters Location-

- 57 Carters Road, Dural NSW 2158, Sydney, Australia

- 22 Broomfield Place, Stoven, United Kingdom

- Ownership / Company Name-Zipphy.com

- Regulated or Blacklisted- Unregulated

- Domain Age-

- Name ZIPPHY.COM

- Registry Domain ID 639749527_DOMAIN_COM-VRSN

- Registered On 2006-10-20T10:03:56Z

- Expires On 2025-10-20T10:03:56Z

- Updated On 2025-01-02T03:58:30Z

What is Zipphy?

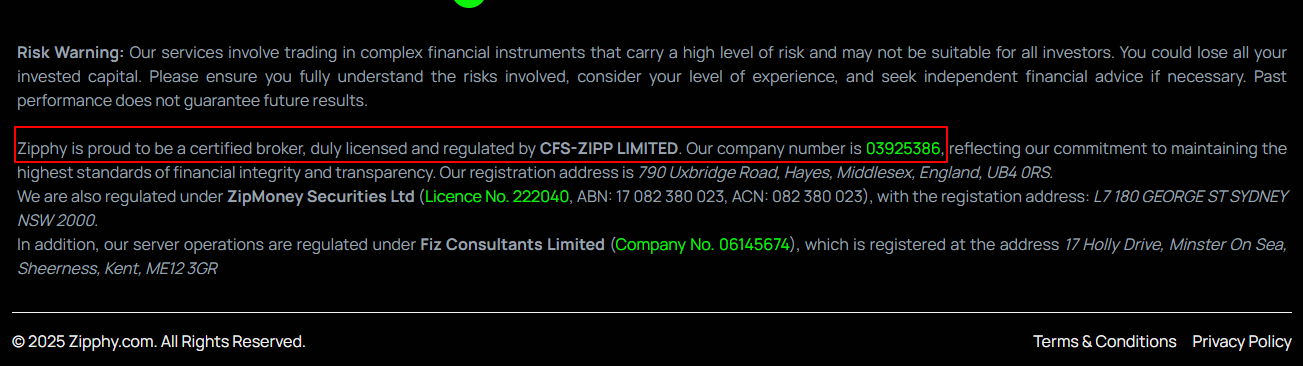

Zipphy presents itself as an investment platform with CFS-ZIPP LIMITED, which claims to be authorized in both the UK and Australia. Their website states the firm has a relationship with the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

Upon reviewing the evidence, however, some discrepancies arise. CFS-ZIPP LIMITED is registered with the FCA, but its verified website domain is cfszipp.com, not zipphy.com. Further, Zipphy claims a relationship with ZipMoney Securities Ltd, an ASIC-regulated firm. However, their website domain is zip.co, which has no relationship to Zipphy.

Why This Matters

- No record with the FCA of Zipphy being a trading name

- No relationship with ASIC between Zipphy and ZipMoney Securities Ltd

- Different website addresses raise a lot of questions about credibility

User Complaints and Red Flags

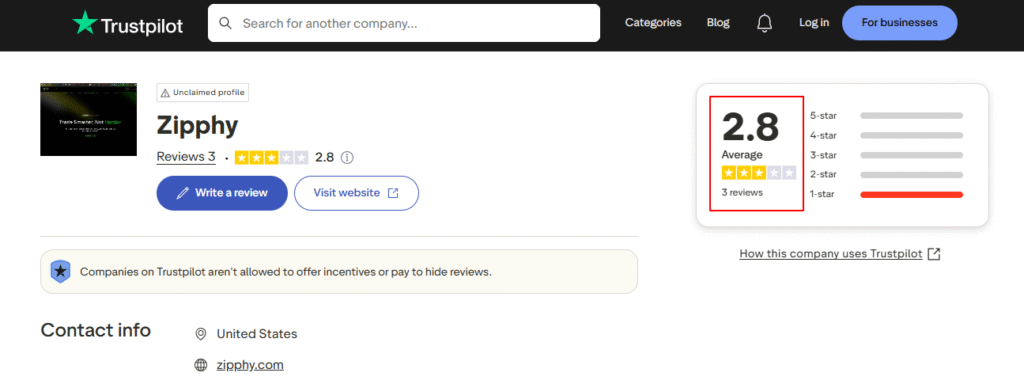

In addition to the regulatory inconsistencies, associating customer reviews introduces additional intelligence applicable to the Zipphy scam story. Zipphy has a rating of 2.8/5 on Trustpilot, with clearly more than one unhappy investor.

Reported Experiences:

- Initial returns paid, but it seems the withdrawals are stalled

- High pressure from WhatsApp and calls, trying to convince users to invest more

- Additional hidden fees, such as “AI system fees,” before withdrawal

- Last part: funds on hold while communication stops

One victim provided, “I invested $100, received delayed returns for three weeks, then when I didn’t pay $500 for their system, they blocked my withdrawal and disappeared.”

Each of these clearly suggests Zipphy fx operates with false claims and predatory tactics.

Zipphy Scam – Risk Analysis

The convergence of:

- False regulatory claims,

- Domain mismatches,

- Pressure marketing, and

- Negative investor experiences,

Indicates that Zipphy is high-risk, and it is likely fraudulent as well.

Conclusion

This Zipphy review has good evidence to suggest that investors should exercise extreme caution. Regulatory claims do not withstand scrutiny, and the consistent complaint pattern appears to fit a classic scam pattern.

How Skyrecoups Can Help

It is difficult and frustrating to deal with losing money to scams such as Zipphy. At Skyrecoups.tech, we understand the stress when your money is stuck and communication ceases. This is why our mission is simple: to provide honest reviews of suspicious platforms and assist victims in fighting back against such scams.

Our experienced team performs due diligence on companies, assesses regulatory claims, domain histories, and assesses customer feedback. We expose discrepancies from reality to ensure that fewer people become victims of platforms that falsely purport to be legitimate.

If you have lost money already with Zipphy or a similar site, then there is no reason to suffer in silence. Skyrecoups provides victims with advice on how to report a scam, suggests steps to start the fund recovery process, and links victims with professionals who specialize in cybercrime or financial disputes.

For more updates, follow us on: